Innovations at the Crossroads: The intersection between medical and computer technology and computing in Europe

Takeaways from this blog

- The intersection of medical and computing technologies in Europe is revolutionizing diagnostics, with a strong emphasis on medical image analysis and efficient managing of extensive imaging data.

- While machine learning and neural networks are key drivers of progress in medical image processing and diagnostics, other essential technologies like image and video recognition, as well as innovative data transfer methods, are equally crucial for improving diagnostic accuracy and system efficiency.

- Investment in medical technology extends beyond diagnostics. There is a big focus on information and communication technology (ICT) to improve overall patient care, modernize healthcare resource management, and support the analysis of clinical trials.

- Although major players own a significant portion of European patent filings, the substantial number of patent applications from entities outside the top 10 shows a dynamic and competitive field. This indicates that smaller companies and emerging innovators are making valuable contributions to advancements in medical technology.

The European Patent Office (EPO) is often perceived as conservative when it comes to the patentability of software, computer inventions, and now AI. However, this should not prevent companies from seeking patent protection in Europe, especially in the medical technology sector, which keeps ranking among the top three technology sub-fields at the EPO.

The purpose of this article is to encourage companies, particularly smaller enterprises, to pursue protection for their innovative ideas in medical technology in Europe. Despite the exceptions to the patentability of methods of treatment and the challenges related to computer-implemented inventions specific to the EPC, there is significant potential for securing patents. In fact, the number of filings continues to increase rapidly, signalling a robust environment for innovation.

EPO patent index in 2022 and 2023

Every year, the EPO publishes the Patent index offering a detailed overview of the previous year's figures and statistics related to filed and granted patents. In 2022 they dedicated a special section to smart health and released a podcast discussing healthcare trends.

The EPO emphasized that smart health is well-represented within the EPO's top three technology fields: digital communication, medical technology, and computer technology. Each of these fields had around 16,000 patent applications filed at the EPO in each of the 2022 and 2023 years. To put this into perspective, these subfields together account for about 25% of all patent applications in those years. This number is nearly double the patent applications filed in the Mechanical Engineering field, which includes technologies from transport and engines to various specialized machines. Furthermore, in 2023, the medical technology field had at least 40% more filings than the fields of biotechnology or pharmaceuticals. This is truly impressive and underlines the innovative nature of the medical technology sector.

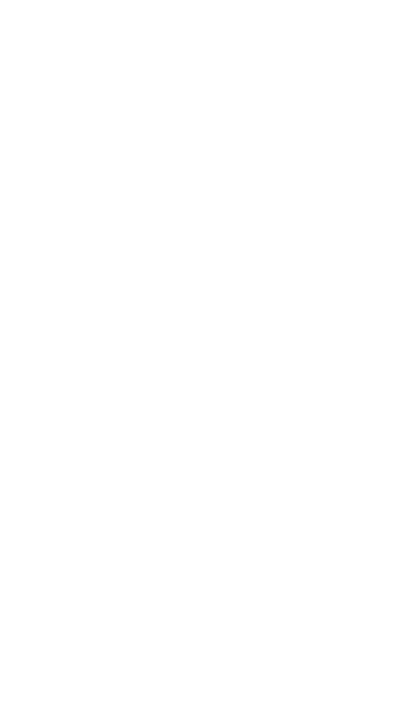

What I found most interesting about the special section on smart health in 2022 was a chart showing European patent applications that incorporate AI in smart health (see below). The chart highlights the increase in five specific topics according to the Cooperative Patent Classification (CPC): medical diagnosis and simulation, automated diagnosis for smart devices, handling and processing medical images, and smart wearable devices. However, the numbers in this chart seem small compared to the nearly 16,000 patent applications filed in 2022 and 2023. This piqued my curiosity about the other patent applications in medical technology—not just those mentioning AI, but more broadly, the publications combining medical technology with computer technology nowadays. I also wanted to identify the major players in this space and determine whether they are monopolizing the field or if it is a more competitive environment.

European Patent applications in Medical Technology published in 2022-2023

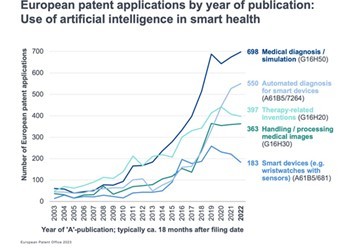

I searched for patent families published by the EPO in 2022 and 2023. The search focused on CPC subclasses A61-B, C, D, F, G, H, J, L, M, and N (covering devices or instruments with medical or veterinary purposes) combined with the G06 class (encompassing various computing technologies). The search yielded 3,392 patent families. I grouped these families by code groups rather than subclasses, as this provides more information about the purpose of the patent applications rather than just the field or subfield.

Let’s delve into the CPC code groups that appear in at least 10% of the patent families, meaning at least 340 families of the 3,392 families found. Keep in mind that patent applications can include multiple codes, and combinations of CPC codes are quite common. For instance, a patent application related to a surgical robot (A61B-034) might also utilize image or video recognition methods (G06V-010).

Medical image analysis

Two group codes are present in almost 40% of the found patent families and are from the computing field, specifically related to image data processing or generation:

- G06T-007: Image analysis

- G06T-2207: Indexing schemes for image analysis or image enhancement (methods or systems for organizing and retrieving information related to images)

These codes indicate that a significant portion of the patent applications combining medical and computer technology focus on the advanced processing and analysis of medical images, which may not be surprising. This includes techniques for enhancing image quality, organizing vast amounts of imaging data, and retrieving relevant information efficiently.

Devices for diagnosis

Following the computing-related group codes, the first group code related to strict medical technology appears with 1,084 instances, about 30% of the families found:

- A61B-005: Measuring for diagnostic purposes.

This is not particularly surprising and aligns with the EPO's 2022 report, suggesting that these trends likely continued into 2023.

Further down the list, in the 13th and 14th positions, we find other CPC group codes more focused on medical applications:

- A61B-006: Apparatus or devices for radiation diagnosis

- A61B-034: Computer-aided surgery; manipulators or robots specially adapted for use in surgery. This code represents a clearer focus on surgical applications, distinct from diagnostic-related technologies seen before. It is not surprising that this is not among the top codes, at least not yet. Developing computer-aided surgery and surgical robots still demands significant resources and investment, so fewer companies are able to engage in this area.

Information and Communication Technology (ICT)

An interesting finding in my opinion is the relevance of the G16H subclass, related to ICT for the medical field:

- G16H-050: ICT for medical diagnosis, medical simulation, medical data mining, and detecting, monitoring, or modelling epidemics or pandemics.

- G16H-030: Processing of medical images and management of healthcare resources.

- G16H-040: ICT specifically for the management and operation of medical equipment.

- G16H-020: ICT for handling prescriptions, steering therapy, and monitoring patient compliance.

- G16H-010: Devices dealing with patient-related medical or healthcare data, such as electronic clinical trials and lab analyses.

The presence of these five codes in the top 15 highlights the wide range of ICT applications advancing various aspects of healthcare and not only diagnosis. They emphasize the increasing investment in integrating technologies aimed at improving patient care and modernizing resource management. These innovations include tecnology to alleviate the workload on medical staff, both within and outside hospital settings, and to enhance the analysis of clinical trials, potentially leading to more reliable and accurate results.

Computational Models

Last but not least, several prominent CPC group codes indicate deeper engagement with computing technologies:

- G06N-020: Inventions in machine learning.

- G06N-003: Computing arrangements based on biological models, such as neural networks.

- G06V-010: Image and video recognition.

- G06F-003: Input and output arrangements for data transfer.

In conclusion, the advancements in processing medical images and achieving more accurate diagnoses are increasingly supported by machine learning and neural networks, which is not surprising. However, it is also important to note that these developments are often complemented by other, less popular technologies, such as image and video recognition, as well as methods for improving data input and output.

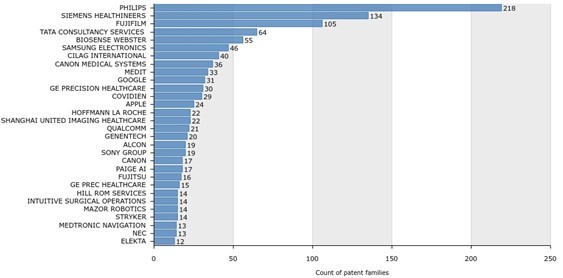

Filings by top applicants

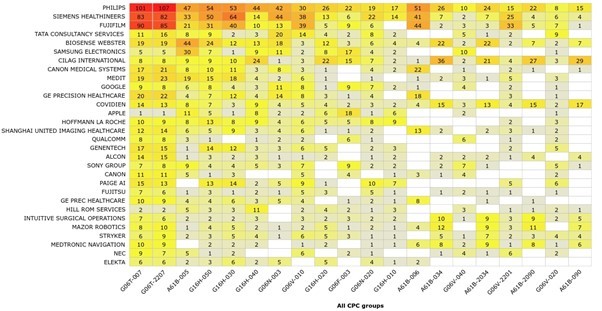

Analysing the applicants of the 3,392 families reveals that 22% are held by the top 10 companies (see graph below). Most of these top applicants were also prominent in the patent index reports in 2022 and 2023, though their rankings varied. For instance, Philips consistently ranked second in both years, while Siemens moved from 10th place in 2022 to 7th in 2023.

Now, let’s examine how these top applicants have been filing in Europe.

The chart below displays the top 30 applicants and the number of their patent applications published in 2022 and 2023, categorized by the CPC code mention before.

It's worth mentioning that while patent publications are a valuable indicator of investment and innovation, they may not represent the entire landscape. Some patent applications, regardless of the size of the company, may have been filed but are not (yet) published. Additionally, there may be innovations in development that are still kept secret and have not been disclosed through a patent application.

Encouraging Innovation and Patent Protection

While it is clear that major corporations like Philips, Siemens Healthineers, and Fujifilm are leading in terms of published patent applications, this does not overshadow the broader landscape of innovation. Despite these top players owning a significant portion of the applications, in inventions related to Image analysis (G06T-007), for example, they account together for only about 300 patents. This leaves around 1,000 applications in this category filed by other, often smaller, entities. This distribution underlines that the patent space is far from monopolized by the largest corporations. Many smaller and emerging companies are actively contributing valuable innovations and seeking patent protection.

The large number of applications from other entities highlights the opportunities for smaller firms and individual inventors to make an impact. The diverse range of applicants, beyond the top few companies, reflects a competitive environment. This suggests that new and innovative ideas are not only welcome but also crucial for advancing technology in the medical field.

For those considering entering this space, it is encouraging to see that the landscape is open. The presence of numerous patent filings by smaller companies indicates a fertile ground for new entrants to protect their innovations and potentially make significant contributions to the field. Thus, seeking patent protection is a viable path for anyone with groundbreaking ideas, ensuring their inventions are recognized and safeguarded in a competitive market

Would you like to dive into our other long reads on Healthcare and IP?

If you would like to know more about how to patent medical devices in Europe, see our other blogs where we provide tips on how to claim these inventions and navigate the exceptions to patentability. For further assistance, consult our patent attorney experts in the field. We can help you protect your inventions and guide you through the patent process with personalized advice and support.